Tech growth stock continues to offer opportunities for investors due to their strong future potential, states entrepreneur and investor Shailesh Dash, who shares his perspective in this monthly column

In recent weeks, the inflation risk has become a new apprehension among equity investors, and understandably so. With the increasingly volatile global economic landscape, investing dynamics have been shifting at an unnerving pace, with little left to predictability. Rising prices have raised concerns around the risk of inflation running higher than target levels, driving rates higher and prompting central bank intervention. Over the past year, governments across the world

have announced stimulus packages and economic relief measures to combat the prolonged economic lull induced by Covid-19. The result has been a build-up of savings among consumers, and a consequent rise in the prices of goods and commodities as economies reopen. In the US, for instance, inflation hit 2.6 percent in the 12 months preceding Marc 2021, breaching the 2 percent Fed target.

Many other major economies have also been witnessing similar risks, and concerns over the impact of an unforeseen surge in inflation on equity markets have led to steep declines across major global equity indices. Investors are spot-on in questioning the rising risk of inflation in the coming months or quarters, but there are mixed views on its impact on the broader capital markets, especially growth stocks.

Economists and market participants believe that the inflationary pressure could be transitory and the slack in global economies could reduce the pricing power from companies going forward. Although businesses are taking the current opportunity to raise prices amid pent-up demand and weak competition, these factors are likely to diminish over a period of time. However, there are concerns around this narrative, that the longer the Fed delays tightening its monetary policy, the more difficult it may get for them to control inflation and longer-term interest rates. The Fed is aware of this risk but the focus is on achieving maximum employment before considering options of tapering monetary policy

Assessing such concerns' rationale has become direly important, especially as the factors driving inflation are unique to the current environment. Over the past few years, growth stocks have emerged as undisputed winners, largely skewed towards tech-based companies. However, for predominantly growth investors, an unexpected surge in

inflation poses higher risks. Despite inflation being largely beneficial for stock markets, investors must make provisions for higher volatility, especially as economies attempt a post-pandemic recovery. It may be wise for investors to consider diversifying their portfolios with a modest inclination towards value stocks, and other assets that act as defenses against inflationary forces – such as precious metals (gold, silver) and real estate. Allocating a portion towards defensive stocks can further act as a haven to reduce the overall risk. However, pulling out entirely from tech and other growth stocks is bound to harm overall portfolio returns and potentially even kill growth strategies.

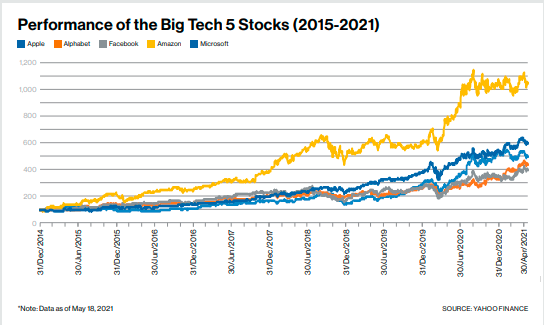

Tech-enabled firms are poised for big gains in the near future, which will likely be driven by technologies such as AI, IoT, big data analytics, and 5G. In order to ensure the best investment strategy and equity portfolio mix, it thus makes sense to go back to basics and analyze key fundamentals while picking stocks. The big tech four companies – Apple,

Google, Facebook, and Amazon – present a stellar example that models the importance of fundamentals in beating market volatility. The 2020 growth story for tech stocks was a phenomenal one, with smaller tech businesses within IT, video conferencing, and other online platforms witnessing staggering returns and sharp price surges However, large tech companies could be the unconventional safeguard key to availing historic long-term returns and to hedging one’s portfolio from inflation and similar risks. The sheer size of these companies, backed by strong fundamentals, has been largely responsible for sustaining their growth amid such tumultuous times. For instance, Apple, Amazon, Facebook, and Google witnessed their stocks jump 82 percent, 76 percent, 33 percent, and 31 percent respectively in 2020.

This reiterates the case for investing in large tech companies with strong fundamentals. Continuing the momentum into 2021, the big four tech firms gave March-end profit reports that surpassed investors’ expectations. Each of these tech firms witnessed stock surges between 7.5 percent and 16.5 percent in April, outperforming the S&P 500’s 5.2 percent rise by a decent margin, despite inflationary concerns.

Technology stocks have already price-corrected from earlier bull-runs, and the current price declines are more likely to present an attractive buying opportunity as opposed to selling in appropriate proportions. It holds true that the current environment is unprecedented, and a great degree of unpredictability still prevails. In short, investors must brace themselves for higher uncertainty in markets, leading to increased volatility.

Regardless, the year 2020 has clearly depicted that investors must remain focused on their investment goals and invest in companies that are expected to continue the growth trajectory. Going forward, any pullback in markets due to inflation fears should be used as an opportunity for investors to load up quality companies with dominant market positioning and the ability to record superior growth. There is large potential within businesses that cater to forward-looking demand, which once again reaffirms the interest boom in tech companies.

Every stock and investment brings its own unique risk-reward packages, and investors should focus on companies with a favorable risk-reward matrix. In a stock market that is running out of positive catalysts, selecting companies with strong fundamentals can push portfolio returns to newer heights. The best portfolio hedge in such uncharted territory thus remains taking calculated risks, while also participating in the historic and unprecedented tech growth story, along the path to global economic recovery.

Comments

You need to Log In to post comments..